Bitcoin slipped under key support at $108,000, gathering liquidity below the $107,000 level on Thursday. The largest cryptocurrency’s holders appear unimpressed by promises from regulators and bullish commentary from U.S. Vice President JD Vance and Senator Cynthia Lummis. BTC could sweep liquidity under the $100,000 milestone this week or over the weekend, analysts warn.

Bitcoin bulls are slowing down, what’s next

Bitcoin’s btc-1.77%Bitcoin maximalists and permabulls are showing signs of slowing down, with Strategy’s purchases declining in volume. Between May 19 and May 25, Strategy acquired 4,020 BTC at $40.61 billion, using proceeds from “Common ATM, STRK ATM and STRF ATM,” according to the firm’s May 26 filing.

Barron’s reported a correlation between Strategy’s Bitcoin purchases and BTC price. While some analysts argue the company’s large acquisitions have positively influenced BTC, TD Cowen examined six months of price action and trading volume and concluded that “MicroStrategy’s purchases represented only a fraction of total Bitcoin trading volume, with a median average weekly result of 3.3%.”

The correlation is insignificant, therefore Bitcoin’s price trend is unaffected by Strategy’s purchases.

News of Wall Street giants and firms adding Bitcoin to their treasuries may have lifted sentiment among traders. However, there is no clear evidence of meaningful impact, and this week, traders remain largely unmoved by both promises and purchases.

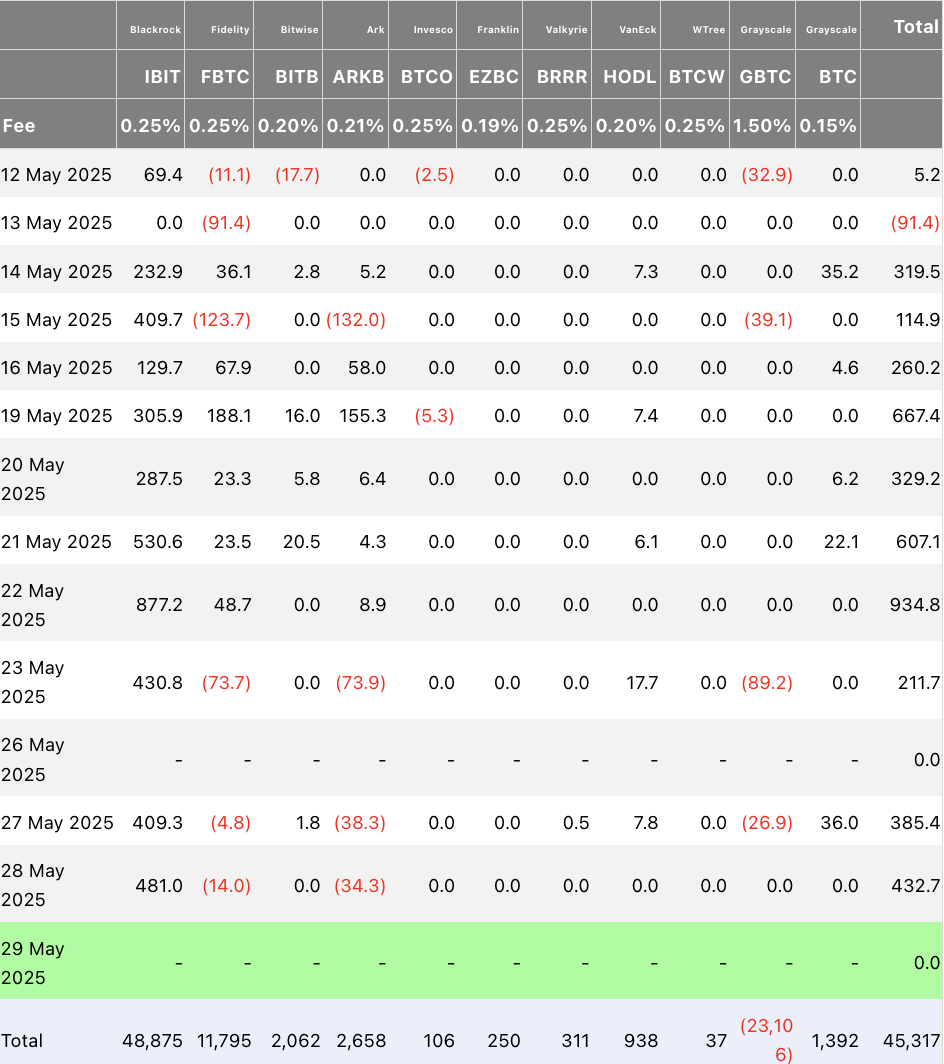

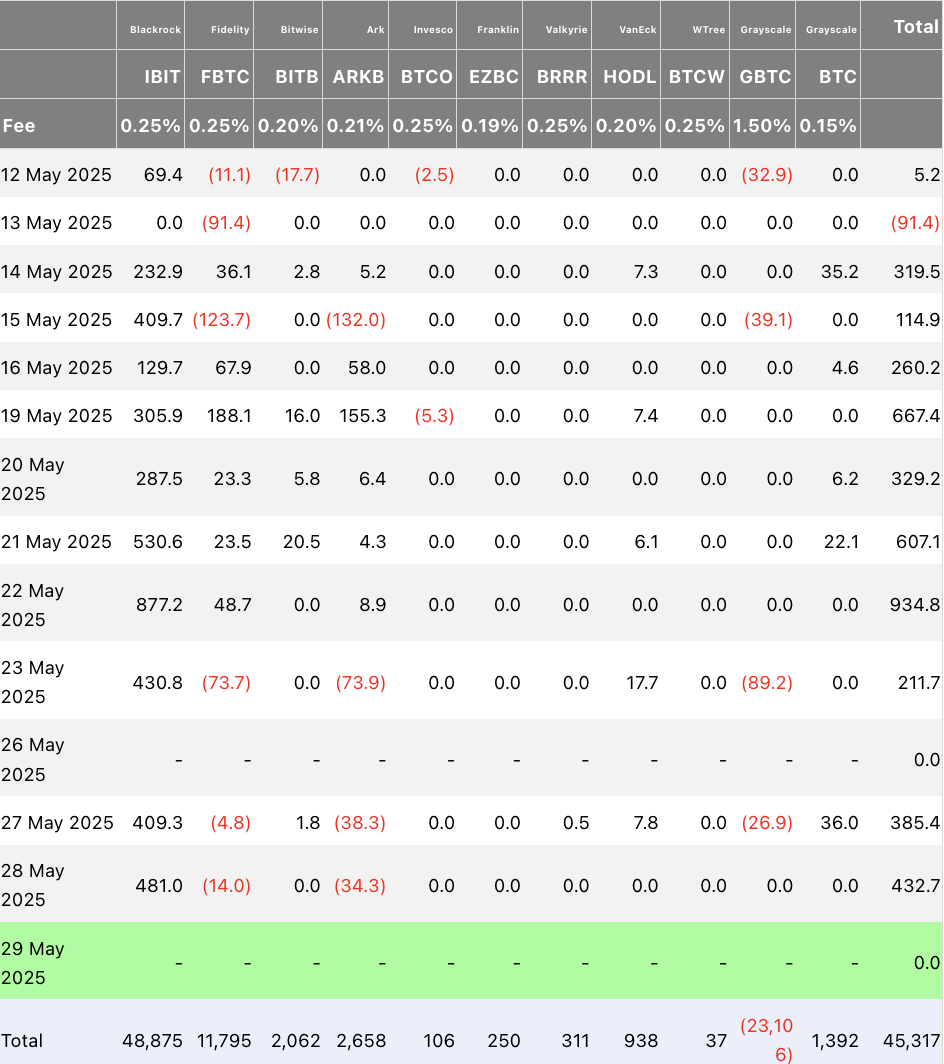

Institutional capital flow into U.S.-based spot Bitcoin ETFs is also declining, while large whales and long-term BTC holders are realizing profits on their positions.

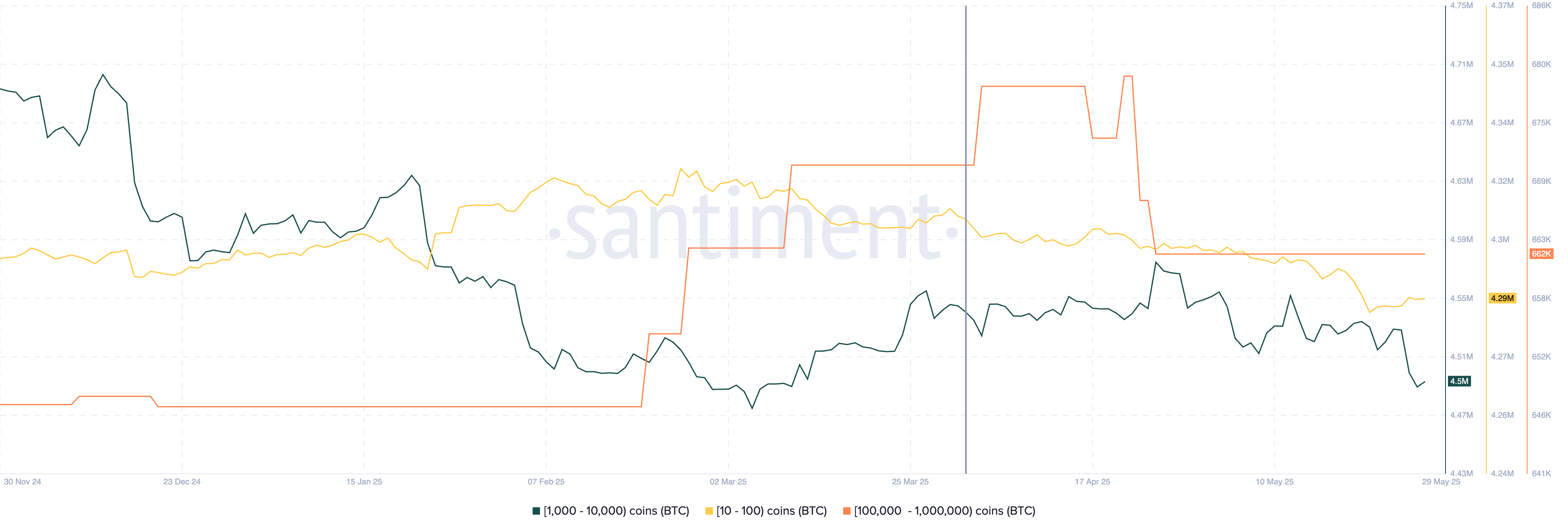

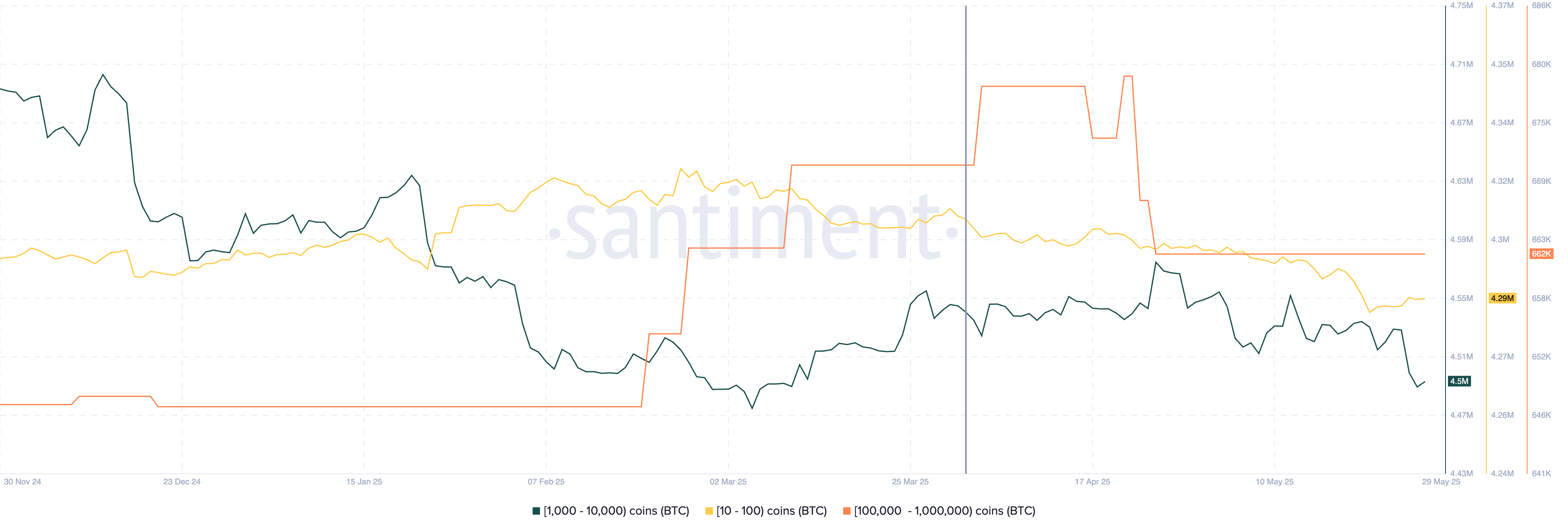

Since April 1, three key segments of Bitcoin holders have shown similar behavior. Addresses holding 10–100 BTC, 1,000–10,000 BTC, and 100,000–1 million BTC have all reduced their holdings, likely cashing out gains from the April to May rally.

Santiment data shows a steep decline in holdings of the three cohorts.

If this profit-taking continues, it could increase selling pressure across exchanges and push BTC lower in the long term.

Bitcoin price forecast

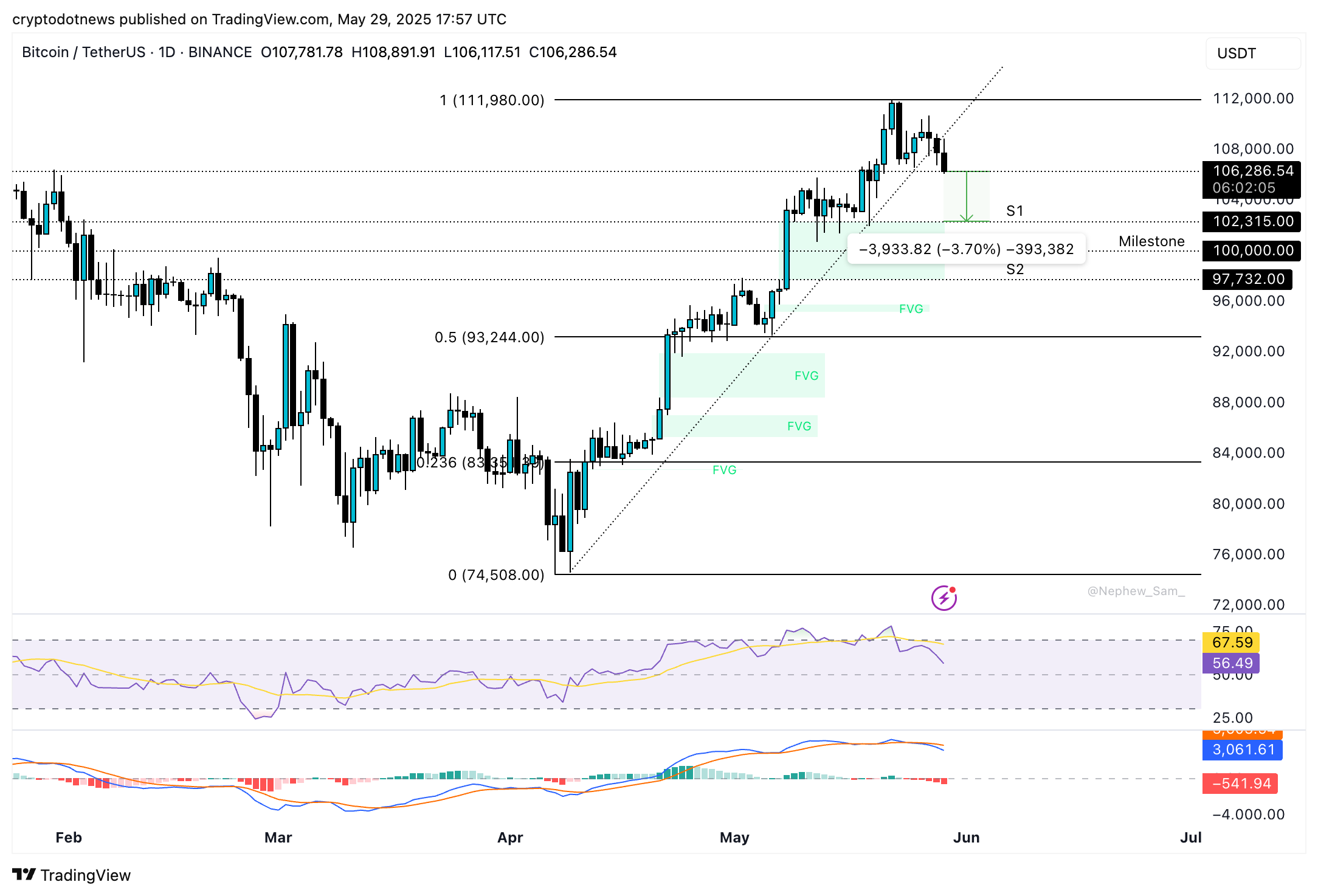

Bitcoin is currently trading under the $108,000 support level, at $106,286 at the time of writing. On the daily timeframe, technical indicators support a bearish outlook. The RSI is trending downward at 56, while the MACD is printing red histogram bars below the neutral line, both signs of weakening momentum.

BTC could collect liquidity at support levels S1 and S2, marking the upper and lower boundaries of the FVG on the daily chart, located at $102,315 and $97,732, respectively. A retest of the $100,000 psychological milestone remains a likely scenario.

Bitcoin is currently less than 4% away from its S1 support. Once the FVG is filled, a recovery may begin, as this zone is marked as a bullish FVG on the BTC/USDT daily chart.

Bitcoin slipped under key support at $108,000, gathering liquidity below the $107,000 level on Thursday. The largest cryptocurrency’s holders appear unimpressed by promises from regulators and bullish commentary from U.S. Vice President JD Vance and Senator Cynthia Lummis. BTC could sweep liquidity under the $100,000 milestone this week or over the weekend, analysts warn.

Table of Contents

- Bitcoin bulls are slowing down, what’s next

- Bitcoin price forecast

- Capital rotation is real though altcoin season is delayed

- Expert commentary

Bitcoin bulls are slowing down, what’s next

Bitcoin’s btc-1.77%Bitcoin maximalists and permabulls are showing signs of slowing down, with Strategy’s purchases declining in volume. Between May 19 and May 25, Strategy acquired 4,020 BTC at $40.61 billion, using proceeds from “Common ATM, STRK ATM and STRF ATM,” according to the firm’s May 26 filing.

Barron’s reported a correlation between Strategy’s Bitcoin purchases and BTC price. While some analysts argue the company’s large acquisitions have positively influenced BTC, TD Cowen examined six months of price action and trading volume and concluded that “MicroStrategy’s purchases represented only a fraction of total Bitcoin trading volume, with a median average weekly result of 3.3%.”

The correlation is insignificant, therefore Bitcoin’s price trend is unaffected by Strategy’s purchases.

News of Wall Street giants and firms adding Bitcoin to their treasuries may have lifted sentiment among traders. However, there is no clear evidence of meaningful impact, and this week, traders remain largely unmoved by both promises and purchases.

Institutional capital flow into U.S.-based spot Bitcoin ETFs is also declining, while large whales and long-term BTC holders are realizing profits on their positions.

Since April 1, three key segments of Bitcoin holders have shown similar behavior. Addresses holding 10–100 BTC, 1,000–10,000 BTC, and 100,000–1 million BTC have all reduced their holdings, likely cashing out gains from the April to May rally.

Santiment data shows a steep decline in holdings of the three cohorts.

If this profit-taking continues, it could increase selling pressure across exchanges and push BTC lower in the long term.

You might also like:BTC, XRP, DOGE owners create financial freedom through RichMiner cloud mining

Bitcoin price forecast

Bitcoin is currently trading under the $108,000 support level, at $106,286 at the time of writing. On the daily timeframe, technical indicators support a bearish outlook. The RSI is trending downward at 56, while the MACD is printing red histogram bars below the neutral line, both signs of weakening momentum.

BTC could collect liquidity at support levels S1 and S2, marking the upper and lower boundaries of the FVG on the daily chart, located at $102,315 and $97,732, respectively. A retest of the $100,000 psychological milestone remains a likely scenario.

Bitcoin is currently less than 4% away from its S1 support. Once the FVG is filled, a recovery may begin, as this zone is marked as a bullish FVG on the BTC/USDT daily chart.

Alternatively, a daily close above $108,000 could invalidate the bearish structure and open the door for a retest of the all-time high at $111,980.

Source: https://crypto.news/