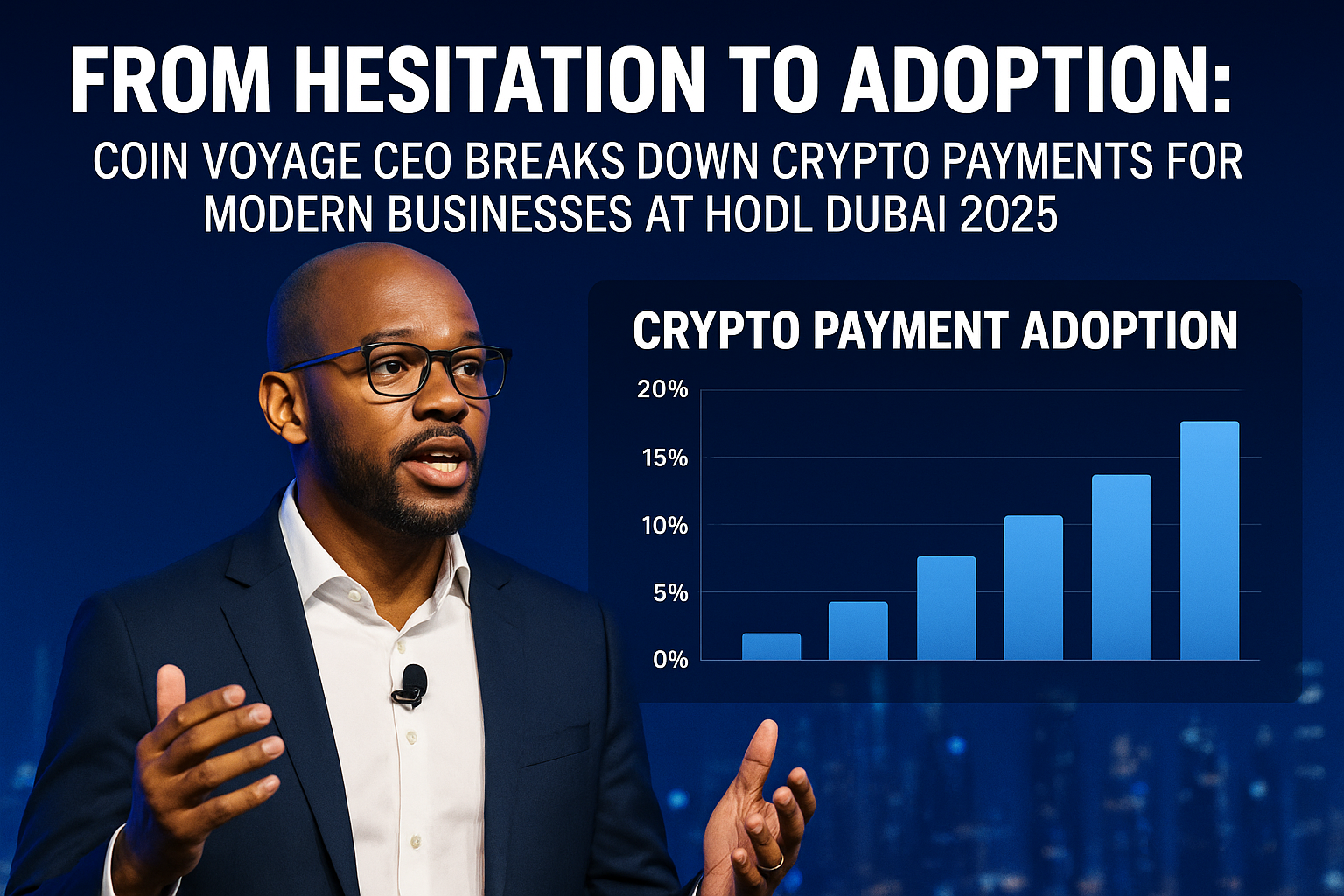

Dubai, UAE – In an increasingly digital economy, where customers demand speed, transparency, and global access, businesses face a critical question: Why aren’t you accepting crypto yet? At HODL Dubai 2025, Erik Astramecki, CEO of Coin Voyage Inc, took the stage to answer that challenge head-on in a compelling session titled “What’s Stopping Your Business from Accepting Crypto?”

Backed by real-world strategies and adoption frameworks, Astramecki’s talk served as both a wake-up call and a playbook for businesses still sitting on the sidelines of the crypto revolution.

Crypto Payments: Not a Trend—A New Standard

“Crypto payments aren’t a passing trend—they’re the new transaction standard,” declared Astramecki as he opened the session. With stablecoins, Layer 2 scaling, and digital wallets rapidly maturing, the friction that once surrounded crypto transactions is all but gone.

He pointed to global brands already accepting crypto—from airlines and luxury retailers to tech giants—and emphasized that businesses embracing digital currencies today are not just innovating—they’re future-proofing.

“This is about staying relevant, expanding access, and building resilience into your payment stack,” he said. “Customers are changing—your payment systems need to catch up.”

What’s Really Holding Businesses Back?

Astramecki outlined five key barriers that often delay crypto adoption among businesses:

- Lack of Strategic Understanding – Many leaders still see crypto as volatile speculation rather than a legitimate payment method.

- Compliance Concerns – Regulatory uncertainty remains a sticking point, especially in traditional industries.

- Technical Integration Fears – Businesses fear complex onboarding and integration into legacy systems.

- Volatility Management – Misconceptions around price swings create hesitancy, even when stablecoins or auto-conversion options are available.

- Customer Demand Misjudgment – Some assume there’s no demand, when in fact crypto-native users are growing across Gen Z and millennial segments.

“These are solvable problems, not immovable obstacles,” Astramecki noted. “And those who act now will gain first-mover advantage.”

The Coin Voyage Framework: From Strategy to Success

To guide businesses through the transition, Astramecki presented Coin Voyage’s Crypto Commerce Framework—a modular roadmap for adoption:

- Step 1: Define Goals

Are you targeting new customer bases? Reducing transaction fees? Enabling cross-border payments? - Step 2: Choose the Right Tools

Payment gateways, wallet integrations, and fiat on/off ramps tailored to your business model. - Step 3: Regulatory Alignment

Work with compliance partners to meet AML/KYC standards and ensure tax reporting readiness. - Step 4: Educate Teams and Customers

Training internal staff and crafting customer-facing materials to build trust and clarity. - Step 5: Launch, Measure, Iterate

Start small, measure results (cost savings, conversion rates), and scale with confidence.

Real-World Impact: Why Crypto Payments Matter

Astramecki shared several success stories, including small merchants who slashed cross-border payment fees by over 60%, and enterprise clients who opened up entire new demographics through crypto loyalty programs.

He emphasized the cost-efficiency, speed, and global reach of crypto payments—not to mention the potential for brand differentiation in a competitive digital market.

“You’re not just accepting crypto—you’re sending a message: We understand the future.”

A Call to Action: Join the Web3 Commerce Movement

Astramecki closed with a powerful call to action for founders, CFOs, and innovation leaders alike:

“Crypto isn’t a risk—it’s a revenue opportunity. The only thing stopping your business from accepting it is fear of the unknown. And that ends today.”

Conclusion: It’s Time to Rethink What’s Possible in Payments

In a world where commerce is global, mobile, and increasingly decentralized, Erik Astramecki’s session at HODL Dubai 2025 was a reminder that the future of payments isn’t approaching—it’s already here. And for businesses that act boldly, crypto won’t just be another option at checkout. It will be a growth engine.

#HODL2025 #AcceptCrypto #CryptoPayments #Web3Commerce #DigitalCurrency #FintechFuture #CoinVoyage #CryptoForBusiness #PaymentInnovation #FutureOfFinance